LIC put Rs 10.7 lakh cr in PSUs under Modi, almost same as investments in 6 decades to 2014

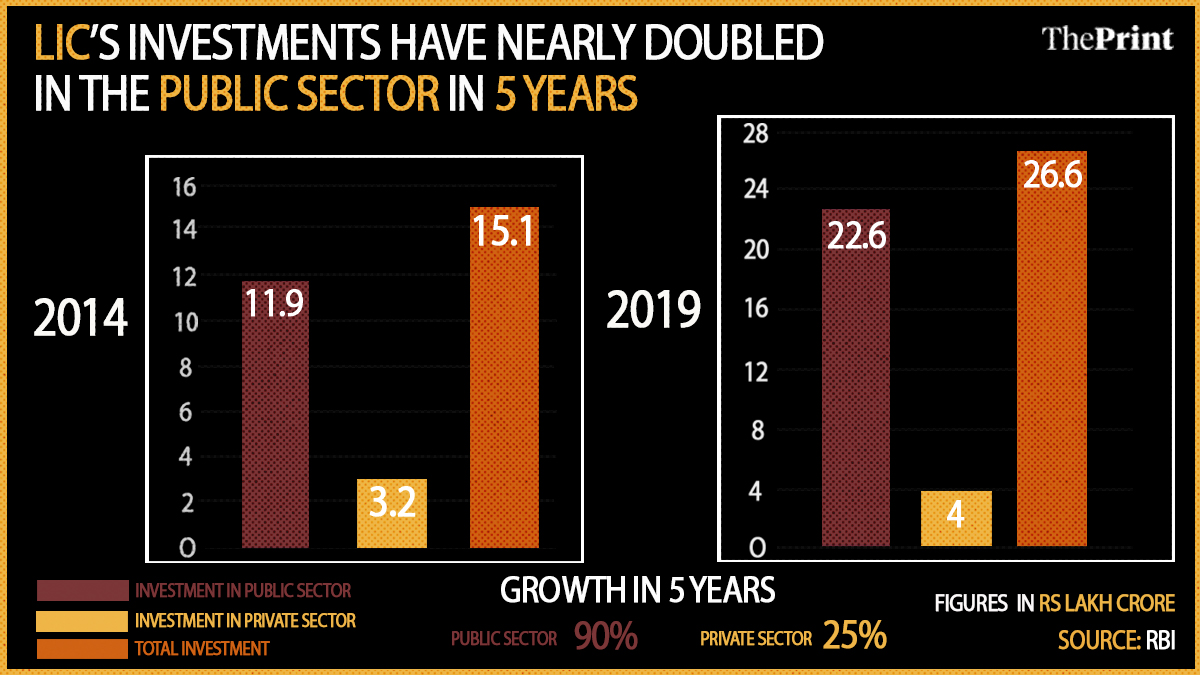

When Modi govt came to power, LIC’s cumulative investment in public sector was Rs 11.9 lakh crore. At the end of FY 2018-19, it jumped to Rs 22.6 lakh crore.

Text Size:

New Delhi: The Modi government’s dependence on public sector firms and off-budget borrowings to make up for its revenue shortfalls and dress up its fiscal deficit numbers has been discovered in another set of shocking data.

The Life Insurance Corporation of India (LIC), according to latest data from the RBI, invested Rs 10.7 lakh crore in public sector firms, many of them ailing banks, between fiscal years 2014-15 and 2018-19 — the first term of Prime Minister Narendra Modi’s NDA government.

This investment of Rs 10.7 lakh crore took the cumulative amount LIC has invested in public sector since its inception in September 1956 to Rs 22.6 lakh crore. In contrast, LIC’s cumulative investment in public sector was Rs 11.9 lakh crore at the end of fiscal 2013-14.

In effect, the LIC under the Modi government invested in public sector in five years 90 per cent of the investments LIC had made in them during its entire existence up to 2014.

The Rs 10.7 lakh crore is also a 72 per cent jump from the Rs 6.2 lakh crore LIC invested in public sector in the five years of UPA-2 when Manmohan Singh was prime minister, data from the Reserve Bank of India’s handbook of statistics on the Indian economy shows.

As of March 2019, 99 per cent of LIC’s investments were in stock exchange securities.

To be sure, LIC’s investments in the public sector had also doubled in the five years ending March 2014 but its investments in private sector firms had also risen nearly 70 per cent during that period.

The Modi government’s dependence on LIC has been increasing over the last few years, and in effect the insurance behemoth has become the lender of the last resort to the government.

From lending a helping hand in many of the government stake sales in state-owned firms or public sector banks, to bailing out fund-starved sectors like railways, road or power, LIC has been at the forefront of many investments in the public sector.

As of March 2019, LIC had total assets of over Rs 31 lakh crore, making it one of the top state-run firms with that kind of financial muscle.

ThePrint reached LIC for a comment but there was no response until the time of publishing this report.

Share in total investments

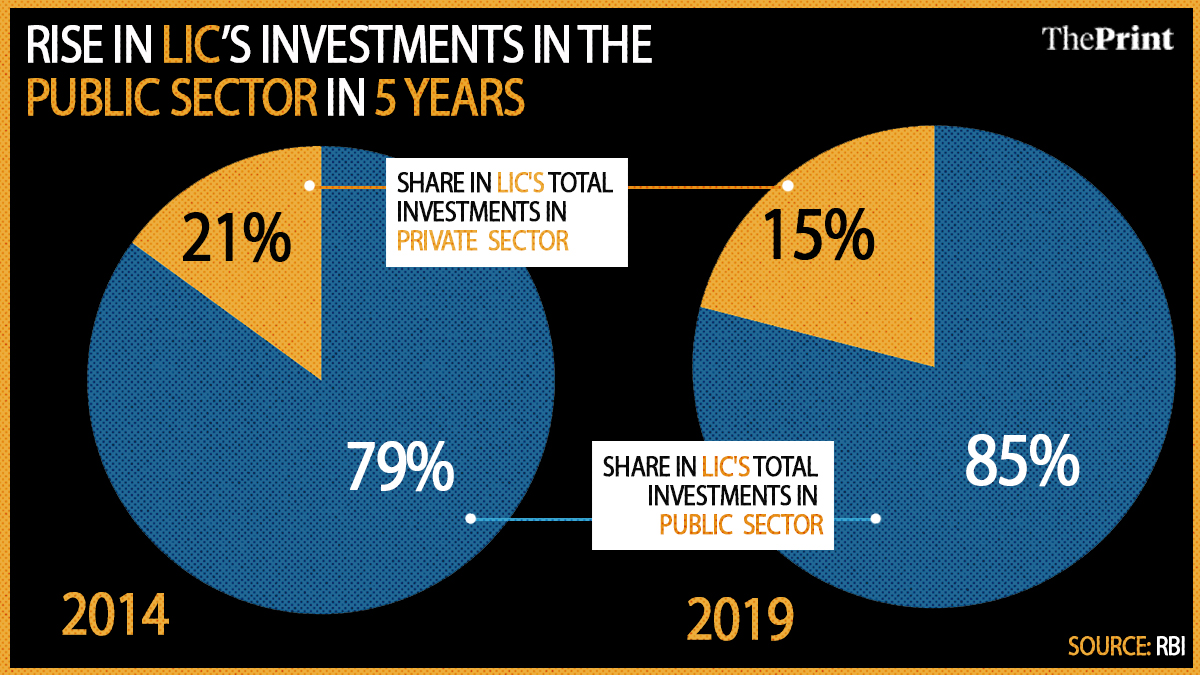

RBI data also shows that the private sector’s share in the total investments of the life insurer came down from 21 per cent as of March 2014 to 15 per cent as of March 2019.

During the same period, the share of public sector in LIC’s investments increased from 79 per cent to 85 per cent.

These investments come at a time when stocks of state-owned firms have lagged their private sector peers.

The S&P BSE PSU index rose 20 per cent in the five years ending March 2019, while the overall benchmark Sensex grew 73 per cent during the period. The Nifty PSE (public sector enterprises) index rose 26 per cent in the same period. In the same time, the Nifty rose 73 per cent.

LIC’s investments

Last year, LIC increased its stake in state-owned IDBI Bank to 51 per cent with an infusion of Rs 21,000 crore in the bank. However, with massive losses wiping out most of the infusion and a fall in the bank’s capital adequacy ratio, the government and the LIC were forced to go in for another round of infusion.

Earlier this month, the Union Cabinet cleared Rs 9,300 crore of capital infusion in the bank with the government and LIC infusing Rs 4,557 crore and Rs 4,743 crore, respectively.

IDBI Bank, which has been now classified as a private bank by the RBI, had posted a loss of Rs 3,800 crore in the June quarter with gross NPAs at 29 per cent.

Over the years, LIC has also picked up stake in other state-run banks — like Punjab National Bank, Corporation Bank, Allahabad Bank and State Bank of India — as the government struggled to adequately capitalise PSBs in line with the levels required by the RBI.

The country’s largest life insurer has also come to the rescue of several public sector undertakings during minority stake sales by the government. LIC was among the major investors in stake sales by the government in PSUs like Coal India, NTPC, NHPC, NBCC and Hindustan Copper over the last few years.

This report has been updated to add the actual investment figures and the comparison between Modi government’s first term and LIC’s cumulative investments until 2014

No comments:

Post a Comment